- Home

- Wertentwicklung Multimanager-Strategien

Wertentwicklung Multimanager-Strategien®

Mit den Multimanager-Strategien® profitieren Sie vom Fachwissen unserer Anlageexperten. Ihr Geld wird in Fonds und ETFs angelegt, welche laufend von den Experten überwacht und wenn notwendig den Marktverhältnissen angepasst werden. Vermögensverwaltung Multimanager-Strategien »

Vergleichen Sie die Bruttowertentwicklung der Multimanager-Strategien:

Daten aktualisiert per 31. Januar 2026

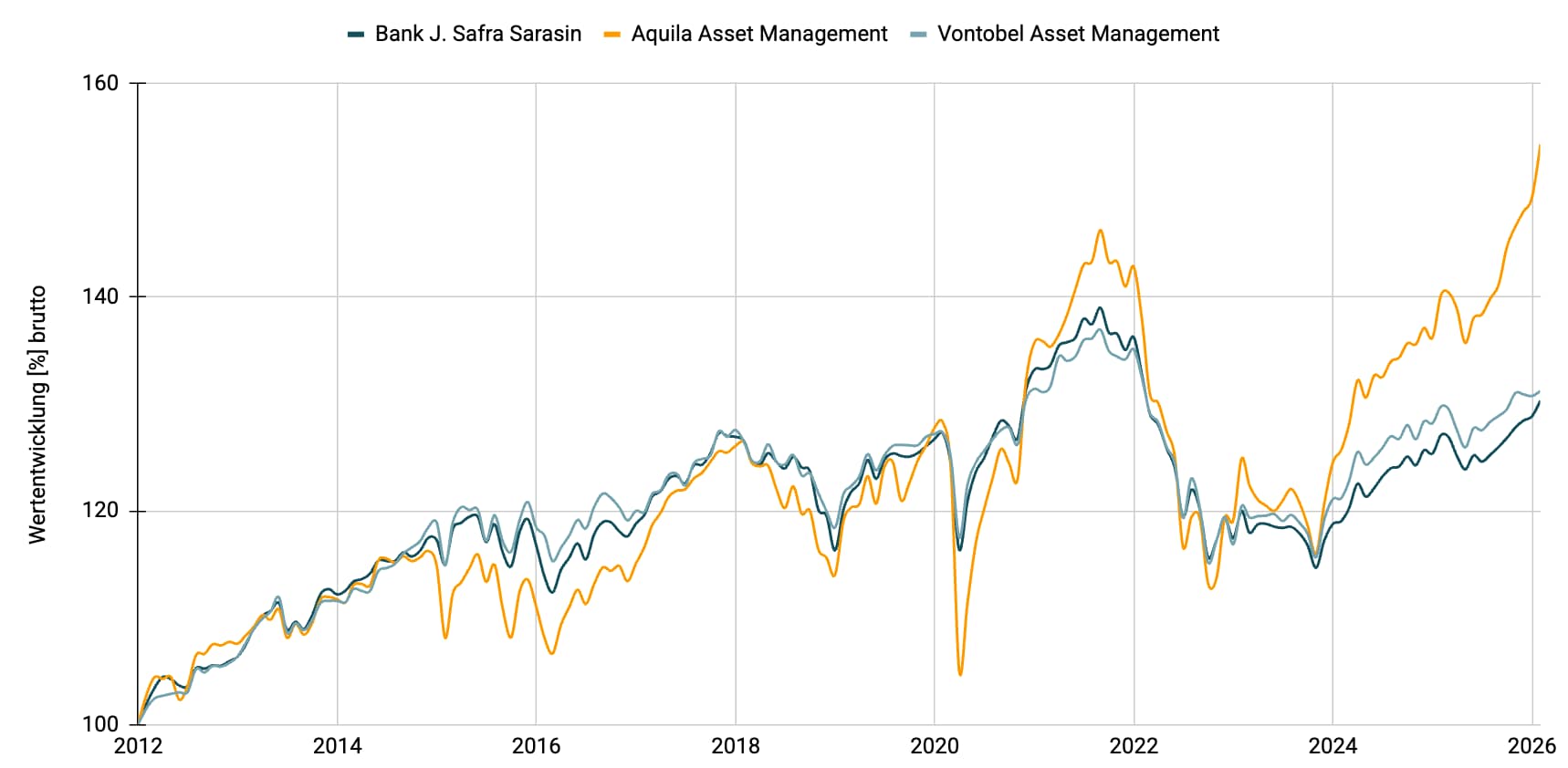

Konservativ CHF

Multimanager - Konservativ CHF

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +1.75% | +6.82% | -8.38% | +8.97% | +5.12% | +2.30% | -13.82% | +1.12% | +5.57% | +2.78% | +1.15% |

| Aquila Asset Management | +3.65% | +9.55% | -9.58% | +12.09% | +6.22% | +5.26% | -16.60% | +4.50% | +9.40% | +9.63% | +3.34% |

| Vontobel Asset Management | +1.30% | +6.31% | -7.19% | +7.42% | +3.32% | +2.82% | -13.51% | +3.62% | +5.87% | +1.98% | +0.37% |

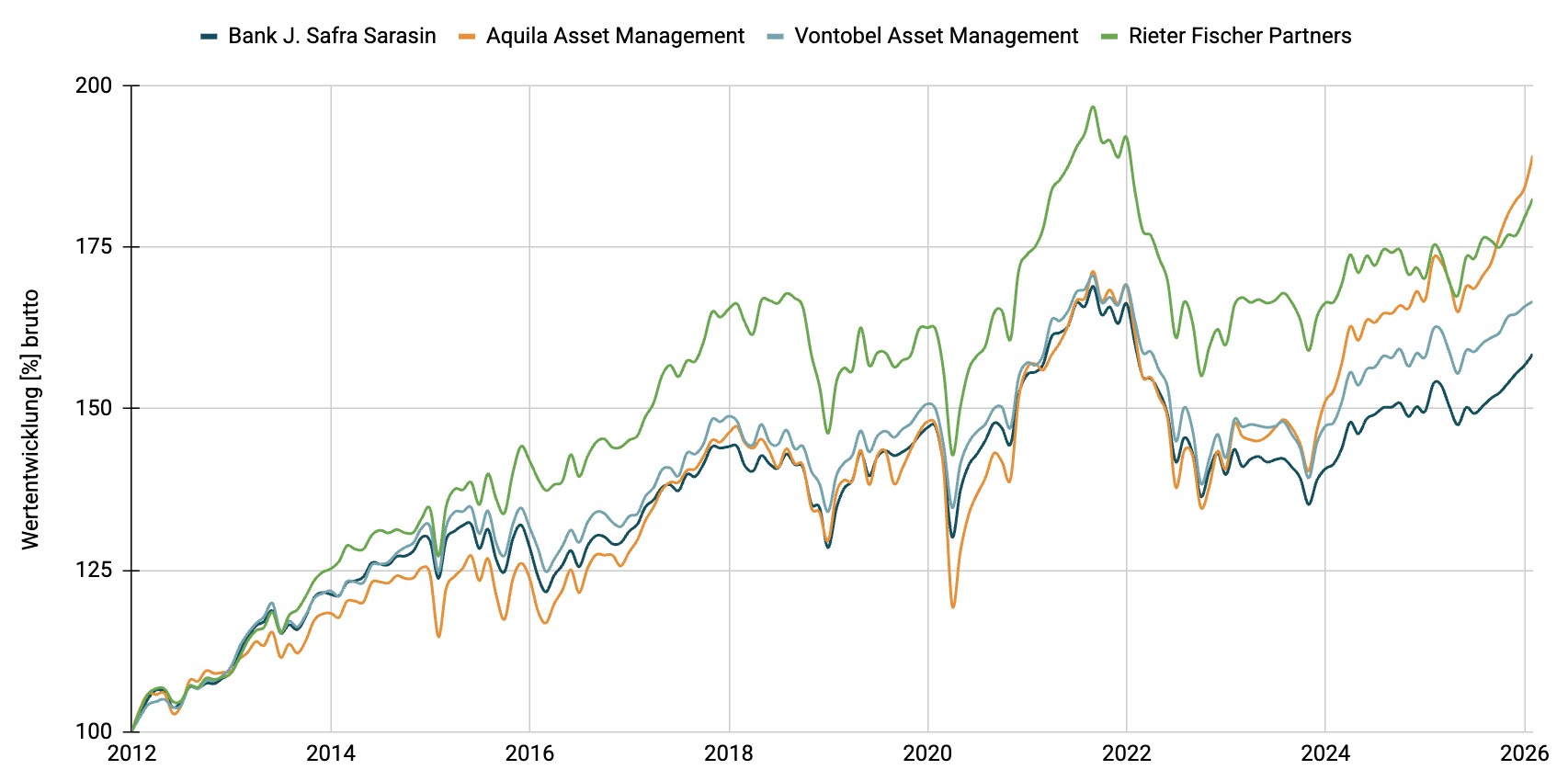

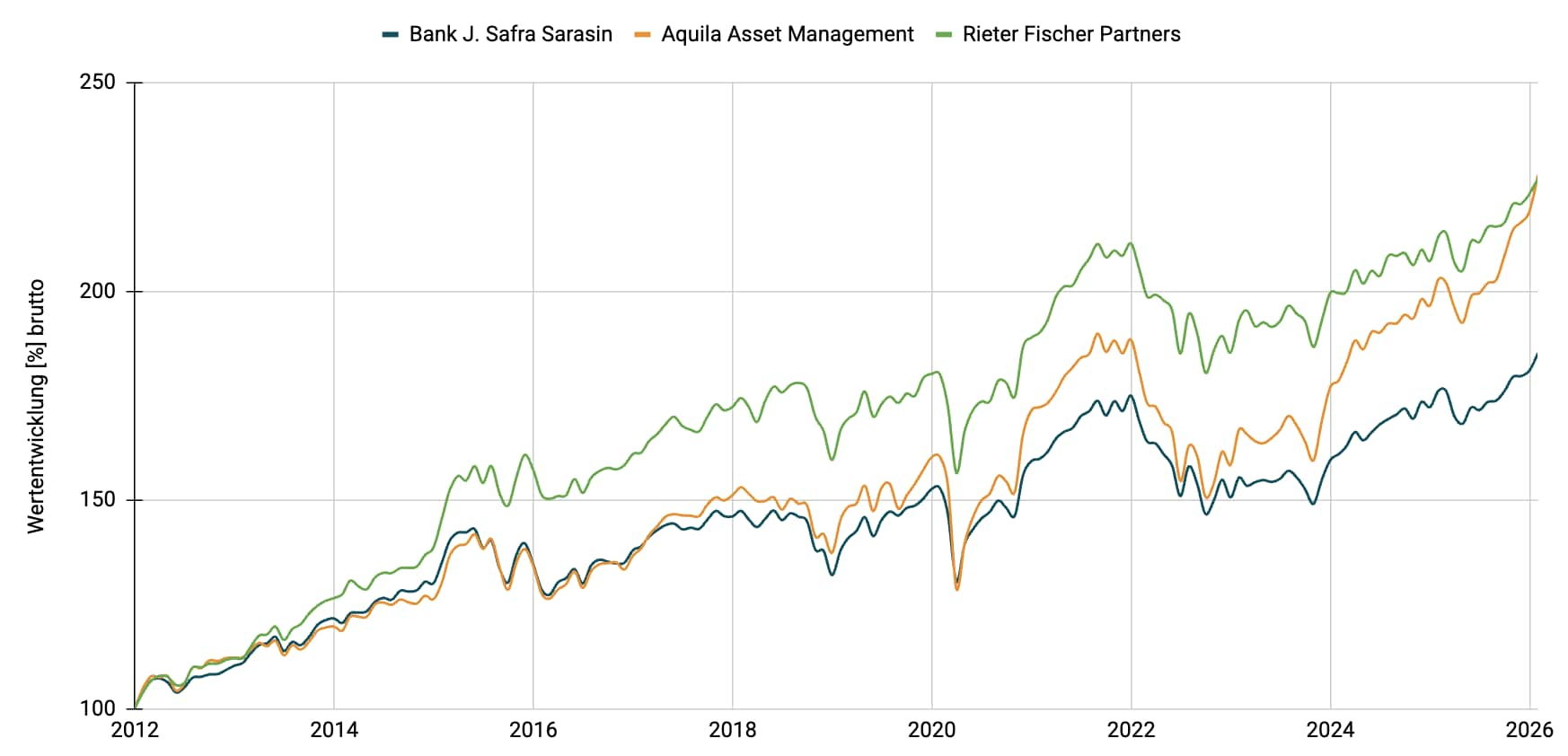

Ausgewogen CHF

Multimanager - Ausgewogen CHF

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +1.86% | +10.01% | -10.86% | +14.48% | +5.57% | +7.12% | -15.95% | +0.65% | +6.33% | +4.76% | +1.15% |

| Aquila Asset Management | +3.25% | +14.37% | -11.42% | +14.27% | +5.63% | +8.21% | -16.84% | +7.45% | +10.33% | +10.43% | +2.75% |

| Vontobel Asset Management | +1.29% | +11.62% | -9.94% | +12.46% | +4.22% | +7.69% | -15.82% | +3.43% | +7.25% | +4.96% | +0.48% |

| Rieter Fischer Partners | +2.22% | +13.96% | -11.61% | +11.18% | +6.97% | +10.46% | -16.74% | +4.06% | +2.30% | +5.50% | +1.64% |

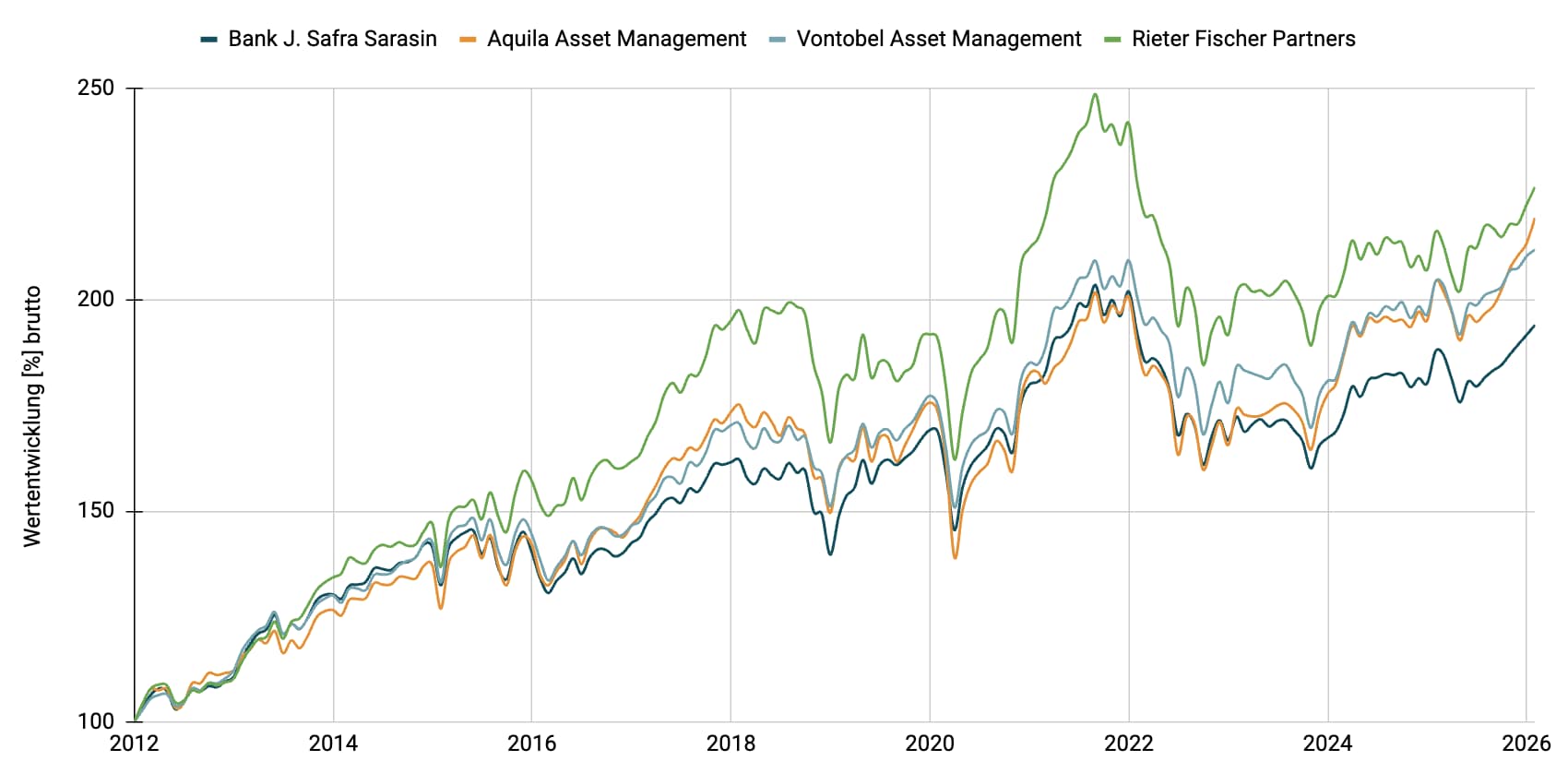

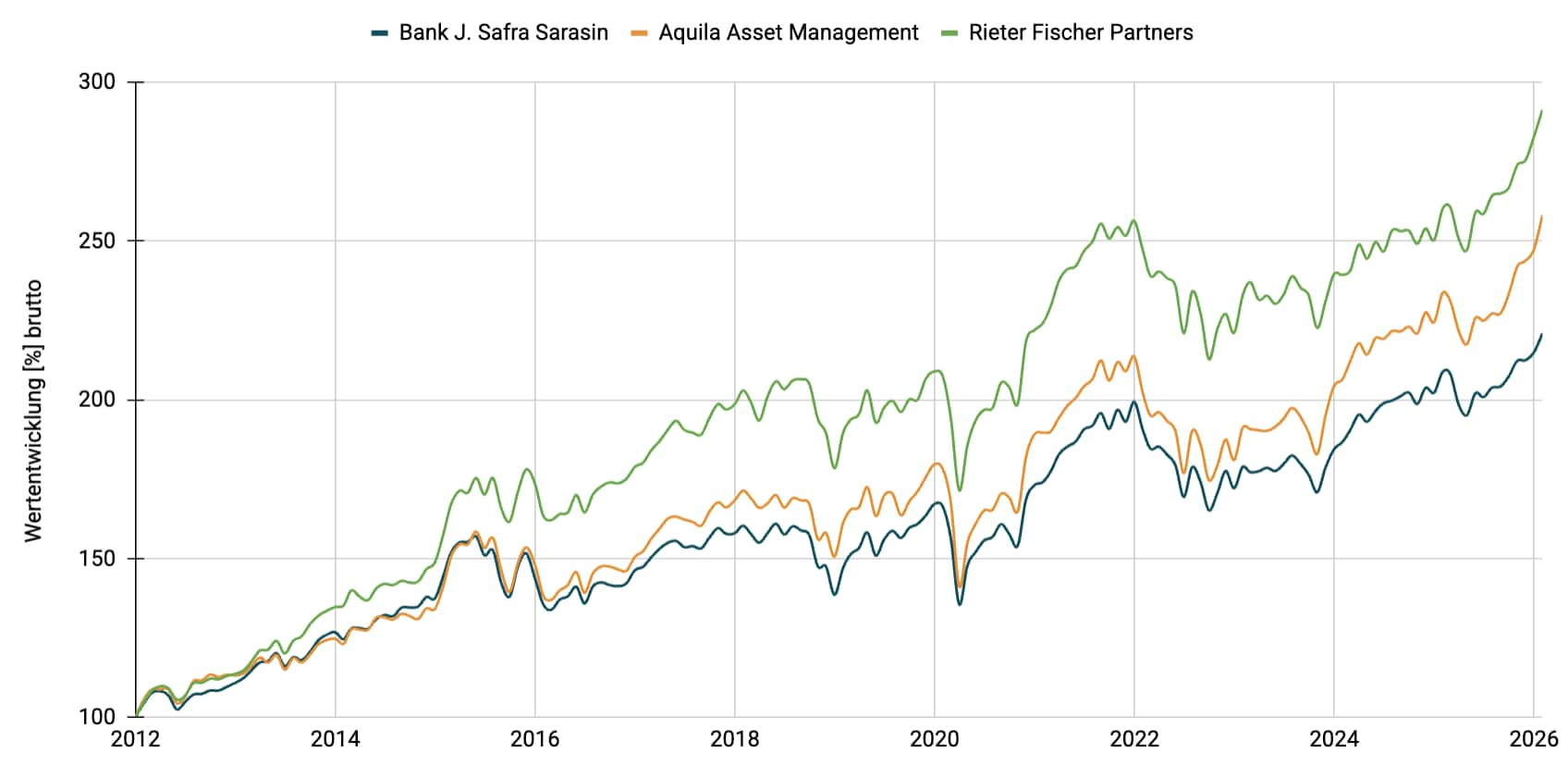

Wachstum CHF

Multimanager - Wachstum CHF

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +1.61% | +13.41% | -13.54% | +21.09% | +6.35% | +12.29% | -17.44% | +0.32% | +7.75% | +6.34% | +1.23% |

| Aquila Asset Management | +3.18% | +18.29% | -13.75% | +17.47% | +3.83% | +10.02% | -17.49% | +7.27% | +9.85% | +9.35% | +2.83% |

| Vontobel Asset Management | +1.46% | +16.23% | -11.25% | +17.29% | +4.37% | +13.14% | -16.15% | +2.96% | +8.73% | +7.00% | +0.74% |

| Rieter Fischer Partners | +2.95% | +20.58% | -14.80% | +15.41% | +10.63% | +13.96% | -20.73% | +4.76% | +3.07% | +7.50% | +1.86% |

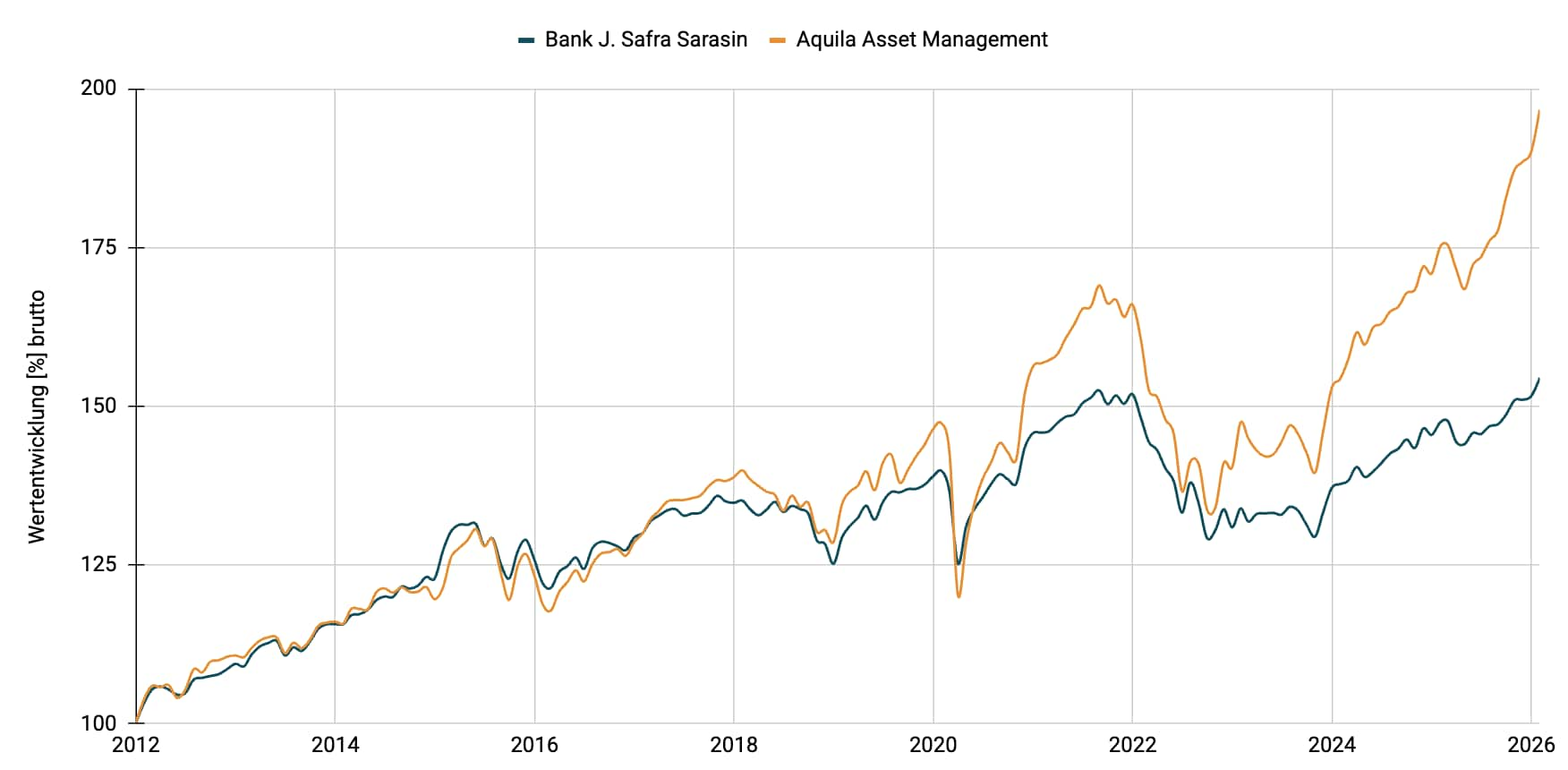

Konservativ EUR

Multimanager - Konservativ EUR

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +2.79% | +4.21% | -7.12% | +11.00% | +4.89% | +4.23% | -13.81% | +4.74% | +6.09% | +4.20% | +1.90% |

| Aquila Asset Management | +4.26% | +7.96% | -7.38% | +13.85% | +6.22% | +6.73% | -15.45% | +8.91% | +11.77% | +11.24% | +3.49% |

Ausgewogen EUR

Multimanager - Ausgewogen EUR

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +2.47% | +5.87% | -9.62% | +15.62% | +4.38% | +9.84% | -13.92% | +5.91% | +7.97% | +5.11% | +2.30% |

| Aquila Asset Management | +1.71% | +10.61% | -9.14% | +16.66% | +6.99% | +9.90% | -15.93% | +11.70% | +11.07% | +11.52% | +3.99% |

| Rieter Fischer Partners | +2.37% | +7.00% | -7.37% | +12.90% | +4.82% | +11.94% | -12.36% | +7.67% | +3.86% | +7.78% | +1.68% |

Wachstum EUR

Multimanager - Wachstum EUR

Quelle: Bank Zweiplus

Übersicht Wertentwicklung (brutto)

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 (YTD) | |

| Bank J. Safra Sarasin | +1.61% | +7.97% | -12.27% | +20.62% | +3.53% | +15.16% | -13.63% | +7.10% | +9.67% | +6.28% | +2.77% |

| Aquila Asset Management | +1.52% | +11.81% | -10.49% | +19.27% | +5.23% | +12.99% | -15.29% | +12.85% | +9.86% | +10.21% | +4.34% |

| Rieter Fischer Partners | +2.90% | +11.03% | -10.14% | +17.08% | +6.22% | +15.50% | -13.76% | +8.34% | +4.48% | +12.99% | +3.01% |