Why invest in AAVE?

Building the Future of Finance

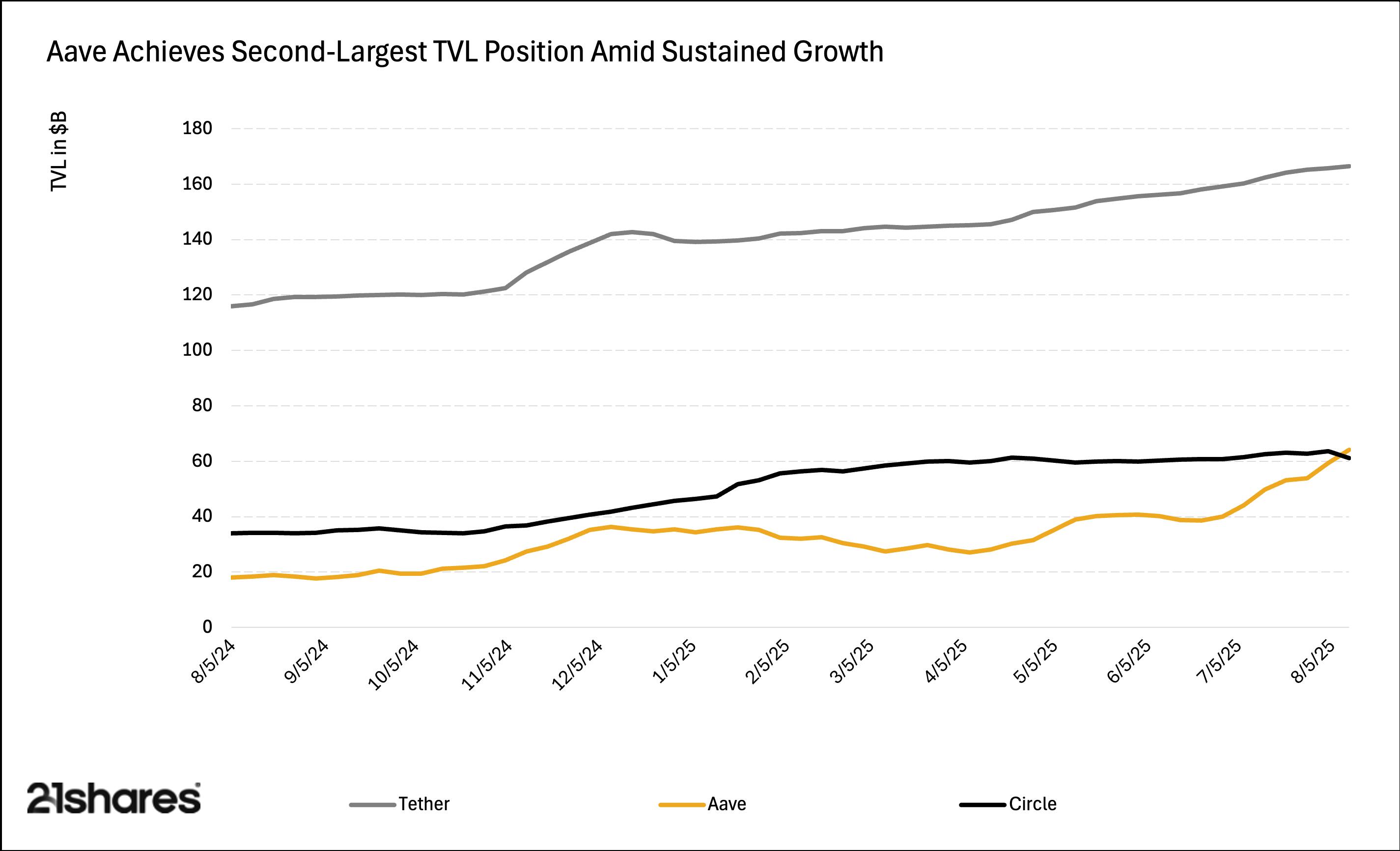

Aave is executing a powerful strategy to cement its role as a pillar of global finance. First, it is evolving from an application into core infrastructure with its own dedicated network for cross-chain lending. This move will unify liquidity, enhance the $AAVE token's role in network security and internalize value currently captured by other chains. Simultaneously, Aave is bridging the gap to traditional finance by enabling tokenized Real-World Assets to be used as collateral, tapping into a multi-billion dollar institutional market. This dual strategy makes an investment in Aave a clear bet on the convergence of DeFi and TradFi, positioning the protocol to capture immense value from both the on-chain economy and the real world. Reinforcing this leadership, Aave now ranks as the second-largest protocol in all of crypto by TVL, with over $39 billion secured across 17 chains.

Poised to Benefit from Regulatory Clarity

As governments move towards establishing clear regulations for stablecoins, Aave stands out as a prime beneficiary. In particular, the signing of the GENIUS Bill in the U.S. and the enactment of MiCA in Europe provide the kind of regulatory clarity expected to boost investor confidence and unlock significant institutional capital for the DeFi sector. With its native GHO stablecoin, Aave is strategically positioned to capture this new wave of investment, which could not only drive growth in GHO itself but also channel substantial flows into Aave’s lending protocol, where stablecoins already play a central role, supporting sustained growth and capital inflows across its ecosystem.

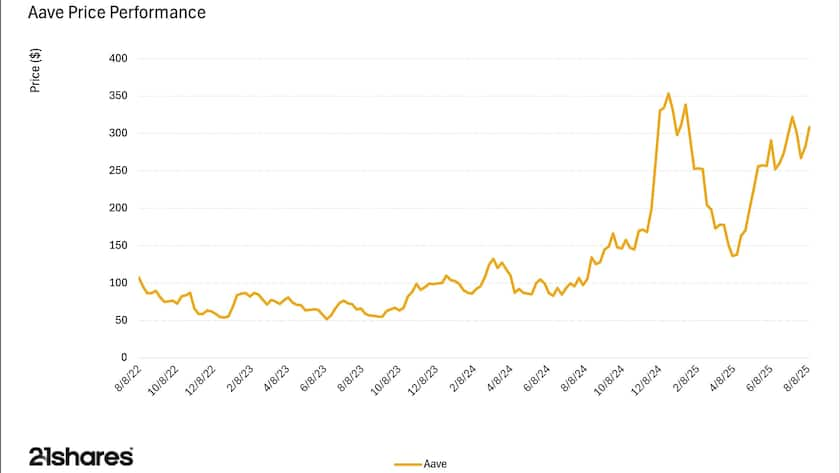

Dominance and Resilience Across Market Cycles

Aave has proven its ability not just to survive volatile periods, but to lead through them. After maintaining its top-tier status throughout the 2022 bear market, its strength was validated in 2025 when its Total Value Locked (TVL) - the total capital entrusted to the protocol - surged past previous records to a new all-time high. This consistent performance underscores Aave's role as a resilient asset and a foundational pillar of the decentralized economy.

From December 30, 2024 to August 11, 2025, Aave (≈$64B) has shown steady growth in Total Value Locked (TVL). This week, it surpassed Circle (≈$61B), becoming the second-largest by TVL and now trailing only Tether (≈$165B), the largest stablecoin issuer.

Why invest in AAVE? Your Benefits at a Glance

The 21Shares Aave ETP (AAVE) offers investors simple and transparent access to the Aave Protocol, one of DeFi's leading decentralized liquidity markets where users can lend, borrow, and earn yield on digital assets, without the significant operational hurdles of direct digital asset investment.

Effortless Access to a DeFi Cornerstone

As a fundamental pillar of the DeFi landscape, the Aave protocol operates as one of the world's largest and most trusted on-chain money markets. The 21Shares Aave ETP is designed to remove the significant operational barriers to entry, offering investors direct access through a streamlined process. With just a single transaction from an existing brokerage account, anyone can gain exposure to this leading lending protocol. This effectively transforms a sophisticated DeFi interaction into a process as simple and familiar as purchasing a traditional stock, allowing investors to seamlessly add a core piece of the on-chain economy to their portfolios.

100% Physically Backed

The product is fully backed 1:1 by physical AAVE which is secured in cold storage by institutional-grade custodians, providing a level of protection that exceeds typical retail custody solutions, just like 21Shares’ other physically backed products.

Regulated Market Access

The AAVE ETP is a regulated financial instrument, listed and traded on several major European exchanges. These venues include BX Swiss, Euronext Paris, and Euronext Amsterdam, with trading available in both USD and EUR. This provides investors with a layer of transparency, oversight, and investor protection standards that are often absent when interacting directly with decentralized or offshore crypto platforms.

21Shares Aave ETP (AAVE) at a Glance

| Product | 21Shares Aave ETP (AAVE) |

| Ticker | AAVE |

| ISIN | CH1135202120 |

| Inception Date | Jan. 31, 2022 |

| Management Fee (TER) | 2.5% |

| Listing Avenues | Euronext Amsterdam Euronext Paris BX Swiss |

| Trading Currencies | USD & EUR |

21Shares Track Record

21Shares offers an extensive crypto product suite, with 45+ ETPs listed on 15+ exchanges, including single-asset and index products, and is a recognized industry leader, having launched the world’s first physically backed crypto ETP over seven years ago. As part of the 21.co Group, which manages over $11 billion in assets globally, 21Shares continues to expand its offerings, leveraging industry-leading research to make crypto investing more accessible to everyone.

Contact Us

For additional information, please contact our us via phone:

- Zurich, ZH, Switzerland: +41 44 260 86 60

- New York, NY, United States: +1 212-223-3460

Or kindly email sales@21shares.com who will happily respond to questions regarding our products. For more information, please visit our website at https://21shares.com/.

Disclaimer:

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG in any jurisdiction. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever or for any other purpose in any jurisdiction. Nothing in this document should be considered investment advice.

This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.

This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States. Neither the US Securities and Exchange Commission nor any securities regulatory authority of any state or other jurisdiction of the United States has approved or disapproved of an investment in the securities or passed on the accuracy or adequacy of the contents of this presentation. Any representation to the contrary is a criminal offence in the United States.

Within the United Kingdom, this document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) persons who fall within Article 43(2) of the Order, including existing members and creditors of the Company or (iv) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Exclusively for potential investors in any EEA Member State that has implemented the Prospectus Regulation (EU) 2017/1129 the Issuer’s Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.

The approval of the Issuer’s Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the Issuer’s Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.

This document constitutes advertisement within the meaning of the Prospectus Regulation (EU) 2017/1129 and the Swiss Financial Services Act (the “FinSA”) and not a prospectus. The 2024 Base Prospectus of 21Shares AG has been deposited pursuant to article 54(2) FinSA with BX Swiss AG in its function as Swiss prospectus review body within the meaning of article 52 FinSA. The 2024 Base Prospectus and the key information document for any products may be obtained at 21Shares AG's website (https://21shares.com/ir/prospectus or https://21shares.com/ir/kids).