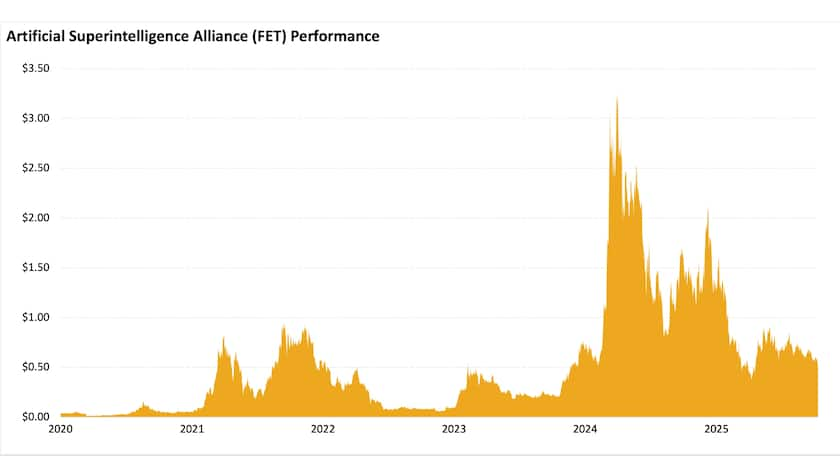

Source: 21Shares, Dune. Data from January 1, 2020 - October 10, 2025

Why invest in FET?

Decentralizing Computing Power

The ASI Alliance has secured over $200M in dedicated AI compute infrastructure, creating the world’s largest decentralized AI compute network. This network democratizes access to powerful GPU resources, ensuring that developers, startups, and researchers—not just a handful of tech giants—can build, train and deploy next-generation AI models. This open and equitable approach fosters innovation and ensures the benefits of advanced intelligence are universally accessible.

A Next-Generation AI Ecosystem

Through the integration of Fetch.ai, SingularityNET and CUDOS, the ASI Alliance has created one of the largest decentralized AI ecosystems in the industry. This merger provides unprecedented utility for FET token holders, spanning AI agents, Artificial General Intelligence (AGI) development, data marketplaces and distributed computing. The ecosystem's innovative power is showcased by ASI 1 Mini, the first Web3-native large language model. It runs efficiently on minimal hardware and allows the community to stake, train and co-own the model. By blending efficiency with decentralized ownership, the ASI Alliance is reshaping the economics of intelligence and positioning ASI as a transformative force at the intersection of Web3 and AI.

Infrastructure for the Intelligence Era

The ASI Alliance is building the backbone for a new intelligence economy with its core innovation: ASI Chain. The first Layer 1 blockchain designed for decentralized AI, autonomous agents and cross-chain interoperability. Featuring scalable throughput of over 1,000 TPS and enterprise-grade security. As the native token, FET powers this entire ecosystem, making it the key to accessing this transformative infrastructure. With enterprise partners like Deutsche Telekom, Bosch, and Alibaba Cloud supporting validator operations, and with the AI-blockchain market projected to exceed $350 billion by 2030, Fetch.ai (FET) is strategically placed to capture long-term growth. This is further bolstered by the rapid expansion of the broader AI market, led by tech giants like Nvidia and OpenAI, which is projected to reach an estimated $4.8 trillion by 2033.

Why invest through the 21Shares Artificial Superintelligence Alliance ETP (AFET)?

The 21Shares Artificial Superintelligence Alliance ETP (AFET) provides investors with efficient and transparent exposure to the ASI Alliance and its unified token, FET, without the operational challenges of direct digital asset investment.

Seamless AI Exposure with Traditional Simplicity

Acquiring FET directly often involves a multi-step process: converting fiat into stablecoins, setting up a specialized wallet and navigating cryptocurrency exchanges. This also places the burden of secure self-custody entirely on the investor. The AFET ETP removes these barriers. It allows exposure to FET through a single transaction from an existing brokerage account, making it as straightforward as buying a stock. This integration enables investors to hold decentralized AI exposure alongside traditional assets in their portfolios.

100% Physically Backed

AFET is fully physically backed 1:1 by FET, which is securely held in cold storage with institutional-grade custodians. This ensures a robust level of protection that surpasses typical retail custody solutions, consistent with 21Shares’ broader range of physically backed crypto ETPs.

Transparent Framework

The AFET ETP is listed and traded on Euronext Amsterdam and Euronext Paris. These listings provide transparency, oversight, and investor protection standards consistent with traditional markets, offering an accessible gateway into the rapidly growing decentralized AI ecosystem.

21Shares Artificial Superintelligence Alliance ETP (AFET) at a Glance

| Product | 21Shares Artificial Superintelligence Alliance ETP |

| Ticker | AFET |

| ISIN | CH1480821375 |

| Inception Date | September 16, 2025 |

| Management Fee (TER) | 2.5% |

| Listing Avenues | Euronext Amsterdam & Paris |

| Trading Currencies | USD |

21Shares Track Record

21Shares provides a comprehensive suite of crypto products, featuring over 50 ETPs listed across more than 15 exchanges, including both single-asset and index offerings. As one of the recognized leaders in the industry, 21Shares launched the world’s first physically backed crypto ETP over seven years ago. As part of the 21.co Group, which manages over $11 billion in assets worldwide, 21Shares continues to grow its product range, leveraging cutting-edge research to make crypto investing more accessible to everyone.

Contact Us

For additional information, please contact our us via phone:

- Zurich, ZH, Switzerland: +41 44 260 86 60

- New York, NY, United States: +1 212-223-3460

Or kindly email sales@21shares.com who will happily respond to questions regarding our products. For more information, please visit our website at https://21shares.com/.

Disclaimer:

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG in any jurisdiction. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever or for any other purpose in any jurisdiction. Nothing in this document should be considered investment advice.

This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.

This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States. Neither the US Securities and Exchange Commission nor any securities regulatory authority of any state or other jurisdiction of the United States has approved or disapproved of an investment in the securities or passed on the accuracy or adequacy of the contents of this presentation. Any representation to the contrary is a criminal offence in the United States.

Within the United Kingdom, this document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) persons who fall within Article 43(2) of the Order, including existing members and creditors of the Company or (iv) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Exclusively for potential investors in any EEA Member State that has implemented the Prospectus Regulation (EU) 2017/1129 the Issuer’s Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.

The approval of the Issuer’s Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the Issuer’s Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.

This document constitutes advertisement within the meaning of the Prospectus Regulation (EU) 2017/1129 and the Swiss Financial Services Act (the “FinSA”) and not a prospectus. The 2024 Base Prospectus of 21Shares AG has been deposited pursuant to article 54(2) FinSA with BX Swiss AG in its function as Swiss prospectus review body within the meaning of article 52 FinSA. The 2024 Base Prospectus and the key information document for any products may be obtained at 21Shares AG's website (https://21shares.com/ir/prospectus or https://21shares.com/ir/kids).